Introduction:

Options trading is a popular investment strategy that allows traders to speculate on the price movement of underlying assets. There are two main strategies in options trading: option buying and option selling. Both strategies have their own advantages and risks, and understanding the key differences between them is essential for successful options trading. In this blog post, we will provide a comprehensive comparison of option buying and option selling, outlining their pros and cons, and summarize the key points in a tabulated format.

Option Buying:

Option buying involves purchasing options contracts, which give the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) before a specified expiration date. Here are the pros and cons of option buying:

Pros:

1. Unlimited profit potential: Option buying offers the potential for unlimited profits if the price of the underlying asset moves significantly in the direction favorable to the option holder's position. This makes it an attractive strategy for traders with a bullish or bearish outlook on the market.

2. Limited risk: The risk in option buying is limited to the premium paid for the option. Even if the price of the underlying asset moves adversely, the maximum loss is limited to the premium paid, making it a relatively lower risk strategy compared to other trading strategies.

3. Simple to understand: Option buying is relatively straightforward, as the trader only needs to decide on the direction (call or put) and the strike price. It does not involve complex calculations or margin requirements, making it accessible to traders with varying levels of experience.

Cons:

1. Time decay: Option buying is affected by time decay, which means that the value of the option decreases as it approaches its expiration date, especially if the price of the underlying asset remains unchanged. This puts pressure on traders to be right in their timing and direction of the market.

2. Lower probability of profit: Due to time decay and the cost of the premium, option buying tends to have a lower probability of profit compared to other strategies. Traders need to overcome the premium cost and time decay to be profitable, which can be challenging.

Option Selling:

Option selling involves writing or selling options contracts, where the seller is obligated to fulfill the terms of the contract if the buyer exercises their right. Here are the pros and cons of option selling:

Pros:

1. Higher probability of profit: Option selling tends to have a higher probability of profit compared to option buying. The seller receives the premium upfront, and if the option expires worthless or the price of the underlying asset remains within a certain range, the seller can keep the premium as profit.

2. Benefits from time decay: Option selling benefits from time decay, as the premium received by the seller upfront erodes over time, potentially resulting in profits for the seller even if the price of the underlying asset remains unchanged.

3. Margin requirements: Option selling may require the seller to deposit margin to cover potential losses, but it can also provide an opportunity to generate income from the premiums received, which can be used to offset potential losses.

Cons:

1. Unlimited risk exposure: Option sellers have unlimited risk exposure, as they may be required to fulfill their obligations if the option buyer exercises their right, regardless of the price movement of the underlying asset. This makes option selling a higher risk strategy compared to option buying.

2. Limited profit potential: Option selling offers limited profit potential, as the seller only receives the premium upfront and the potential profit is capped at the premium received. This may not be as attractive for traders with a bullish or bearish outlook on the market.

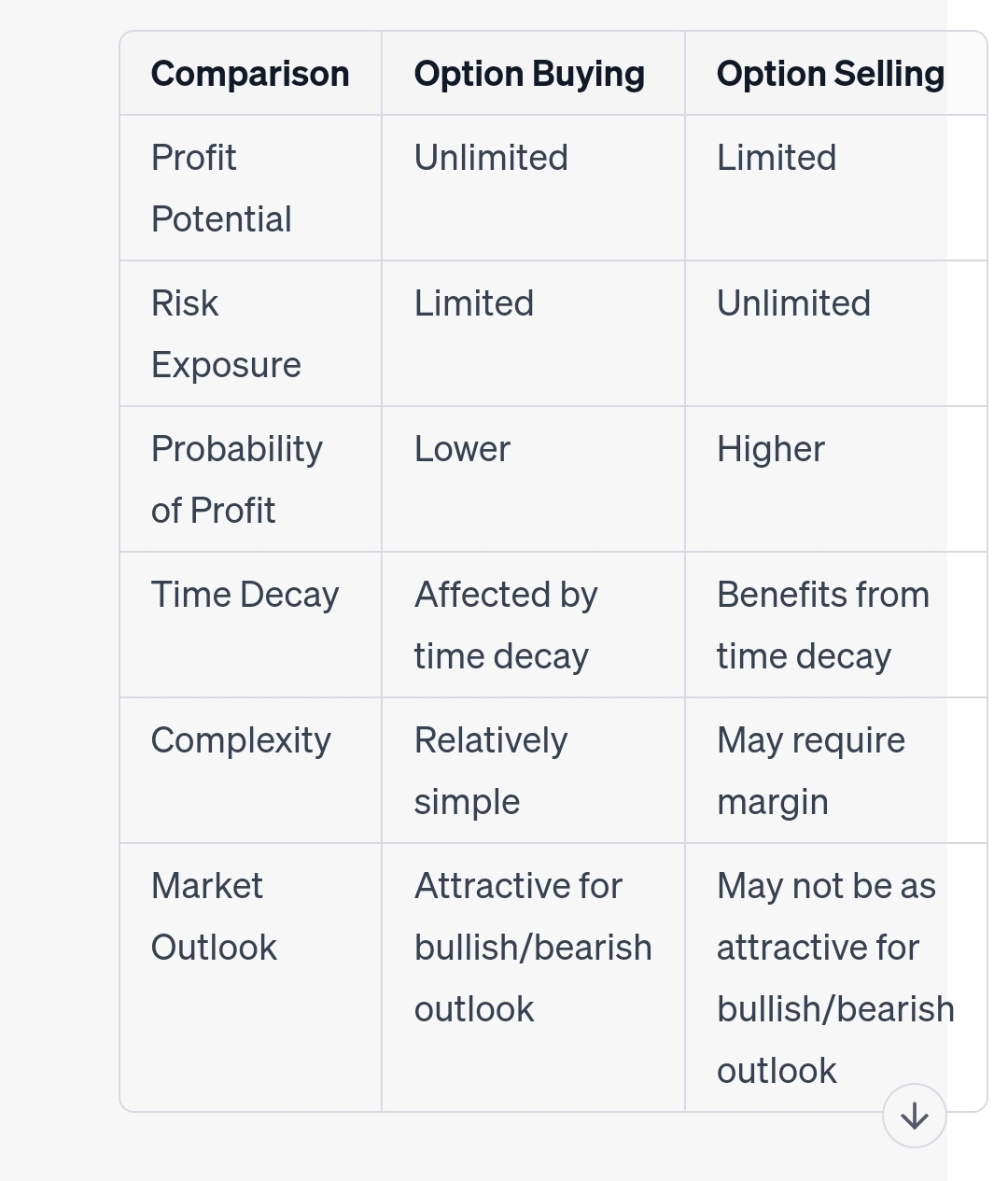

Tabulated Summary:

Here's a summary of the key points comparing option buying and option selling in a tabulated format:

Conclusion:

In conclusion, option buying and option selling are two different strategies in options trading, each with its own pros and cons. Option buying offers the potential for unlimited profits but comes with limited risk and may be more suitable for traders with a bullish or bearish outlook. On the other hand, option selling has a higher probability of profit, benefits from time decay, but carries unlimited risk exposure and may require margin. Traders need to carefully consider their market outlook, risk tolerance, and trading objectives before choosing between option buying and option selling. It's essential to thoroughly understand the risks and rewards associated with each strategy and implement proper risk management techniques in options trading. Consulting with a qualified financial professional can also provide valuable guidance in making informed decisions.